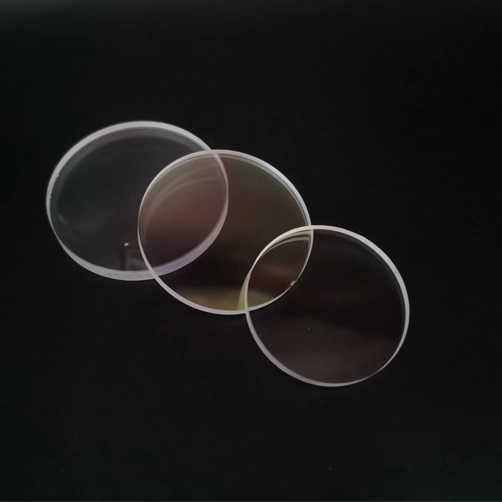

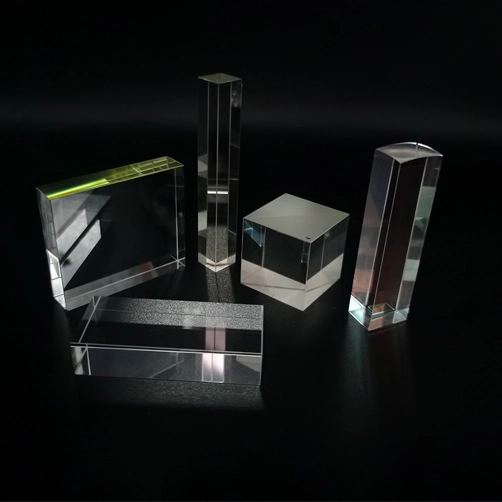

Optical components refer to the main components in optical systems that use optical principles for various observations, measurements, analysis records, information processing, image quality evaluation, energy transmission, and conversion. Optoelectronic components are functional devices made using the effect of electron-photon conversion. With the advancement of science and technology and the innovation of production technology, modern optics and optoelectronics are closely intertwined and integrated into technology and application fields, and the applications of optical imaging, perception, and display are becoming more and more extensive.

At this stage, the downstream and terminal industries of optical and optoelectronic components are developing rapidly, and the technology is rapidly upgraded and iterated, driving the technological progress of optical and optoelectronic components. Optical and optoelectronic components are mostly used in biometrics, camera modules, and security surveillance markets.

1. Biometrics

As people's requirements for identity security verification increase, the advantages of biometric technology have gradually become prominent. Object recognition technology closely combines computers with optical, acoustic, biosensor, and biostatistics principles through high-tech means, and uses the inherent physiological characteristics and behavioral characteristics of the human body to identify personal identity. Data show that in 2019, the global biometric technology market reached US$20 billion. With the continuous investment of global high-tech companies and the continuous expansion of the application market, the size of the biometric technology market will grow to 23.72 billion U.S. dollars in 2021.

2. Camera module

With the development of information technology and robotics, consumer electronic products such as smartphones, video surveillance systems, and car cameras are showing the development trend of digitalization, high-definition, networking, and intelligence. The camera module that determines imaging sensitivity, resolution, and noise is an important part of the consumer electronics industry chain. Optical precision components play a crucial role in enhancing the performance of these camera modules. The global market for smartphones, smart tablets, video surveillance systems, and smart car cameras has developed rapidly, and the shipments of camera modules have achieved substantial growth. In 2019, the global camera module market has reached 29 billion U.S. dollars and is expected to continue to grow at a compound annual growth rate of 9.1% in the next 5 years to 45.7 billion U.S. dollars in 2024.

1. Optical and optoelectronic components have a wide range of applications and huge market potential

With the continuous development of smartphones, security monitoring, and other industries, the market demand for high-definition lenses and high-end optical sensors is strong, which in turn drives the market demand for various optical and optoelectronic components. The development of new technology fields such as 5G, AR/MR equipment, smart cars, machine vision, and drones has also opened up broad application prospects and market space for optical and optoelectronic components. The development of science and technology and market demand has also accelerated the wide application of optical and optoelectronic components in the fields of new energy, new materials, biotechnology, medicine, environmental science, and remote sensing technology.

2. The industry tends to be centralized

With the continuous improvement of technology in the downstream terminal field, the continuous expansion of application scope and the acceleration of product update iterations, the requirements for optical and optoelectronic components are becoming higher and higher. For example, the development trend of smart phones in the main downstream areas is the application of biometrics and high-pixel multi-cameras, which have extremely high accuracy requirements for various components of biometrics and cameras. Only the optical and optoelectronic component companies with strong comprehensive competitiveness can meet the high requirements of customers in terms of output, technology, efficiency, etc., so as to seize market opportunities and expand market share. The lack of strength of manufacturers will gradually be eliminated in the development of the industry, and the optical and optoelectronic industry will move toward industrial concentration.

3. High industry barriers and low substitution

The production of optical and optoelectronic components requires high-level R&D and designers, expensive precision processing equipment, and experienced technicians. In addition, downstream customers have strict certification procedures and long certification cycles for suppliers, so after reaching a good cooperation, the possibility of replacing suppliers is low. In addition, since most of the optical and optoelectronic components are developed and produced on a project basis, companies will be exposed to new technologies that customers need to keep secret in the process of cooperating with customers. Customers will tend to choose to establish partnerships with companies with good reputation and trustworthiness. And customers will not easily change suppliers. These high barriers constitute the "moat" of the optical and optoelectronic components industry, making it less substitutable and capable of long-term development.